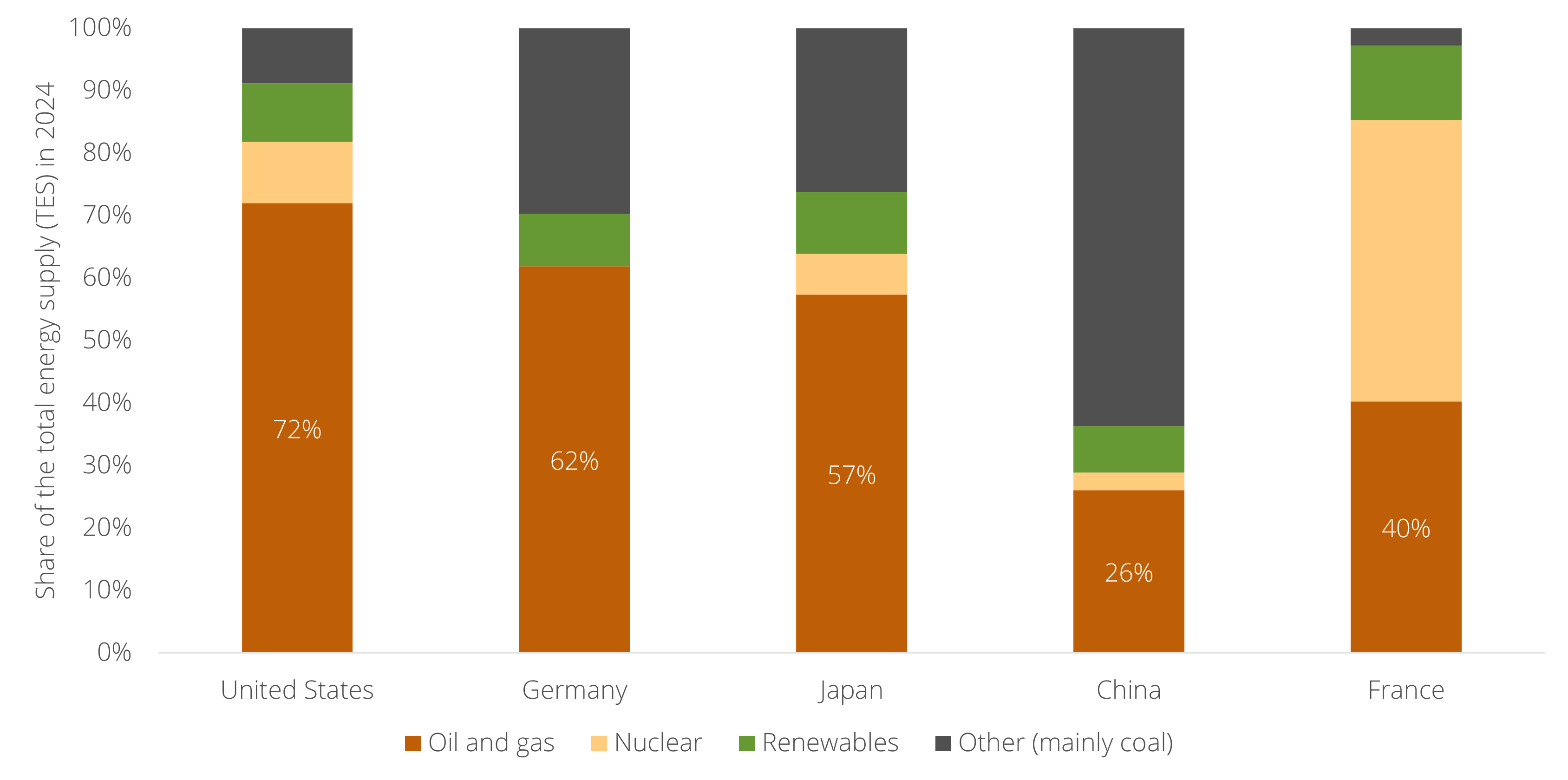

As the war in the Middle East continues to push up prices for oil and gas, two countries find themselves relatively well positioned – because they have been preparing for this scenario for decades: France and China. Both have pursued energy security through a mix centered on nuclear power and renewables, reducing their structural dependence on imported oil and gas.

For France, the vision dates to the 1973 oil crisis. Before it, France imported around 75% of its energy and had almost no domestic fossil fuel resources of its own. The response was the Messmer Plan of 1974 – a state-directed mobilization to build out nuclear capacity at a scale that remains unmatched in the Western world. Fifty years later, that bet is paying off.

In China, decades of industrial policy have been shaped by a refusal to become dependent on imported oil and gas – a vulnerability that Chinese planners call the "Malacca Dilemma": the risk that foreign powers could strangle Chinese energy supply by blocking maritime routes (like the Strait of Malacca, or currently, the Strait of Hormuz). Coal, despite its pollution, remains China's dominant energy source today, but explicitly as a bridge, not a destination. The destination is a mix of nuclear and renewables on a scale the world has never seen: more than half of all nuclear reactors currently under construction are in China, and China installs more solar capacity each year than the rest of the world combined.

The irony is that two very different political systems arrived at the same conclusion through the same logic: that the energy mix of nuclear and renewables is not merely relatively good for the environment, but offers energy security for the nation.

Most people expect the war in Iran to end within days or weeks - much like the predictions surrounding Ukraine in February 2022. But a weak regime does not guarantee a short war. It merely means a more unpredictable outcome.

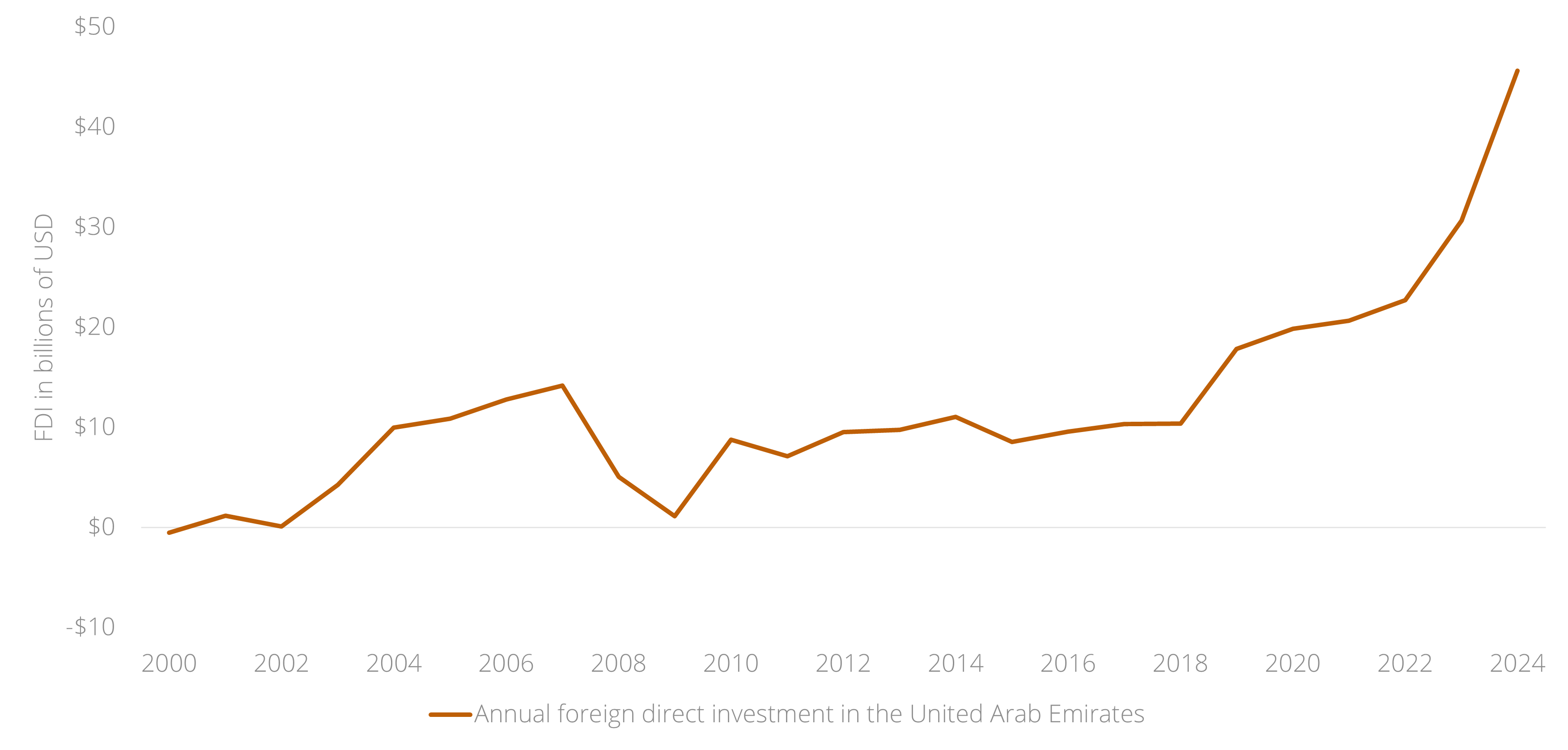

As we wrote in January, the weakening of the Iranian regime has opened a contest for control of the region. Israel, Turkey, Saudi Arabia, the United Arab Emirates, and Qatar are all vying for influence - and none of them want the same outcome in this war. Israel and Turkey were already at odds: former Prime Minister Naftali Bennett publicly framed Turkey as a threat on par with Iran. Now Israel is at odds with the Gulf states, whose entire economic model depends on the war ending immediately.

For decades, the Gulf states built their global standing on a single promise: whatever happens in the Middle East, the Gulf remains stable. That promise has now been broken. Missiles have struck Dubai's airport and hotels and killed civilians in Abu Dhabi. Thousands of travelers are stranded across the region - unable to fly home or forced to pay a massive premium to flee via Riyadh. Within days, the Gulf's reputation as a safe haven is already in serious doubt.

The most common critique of China’s innovation goes like this:

"Sure, China leads in solar panels and batteries – but those were invented elsewhere. And research dominance doesn't mean commercial success.“

It seems like a reasonable critique, but the data doesn't support it.

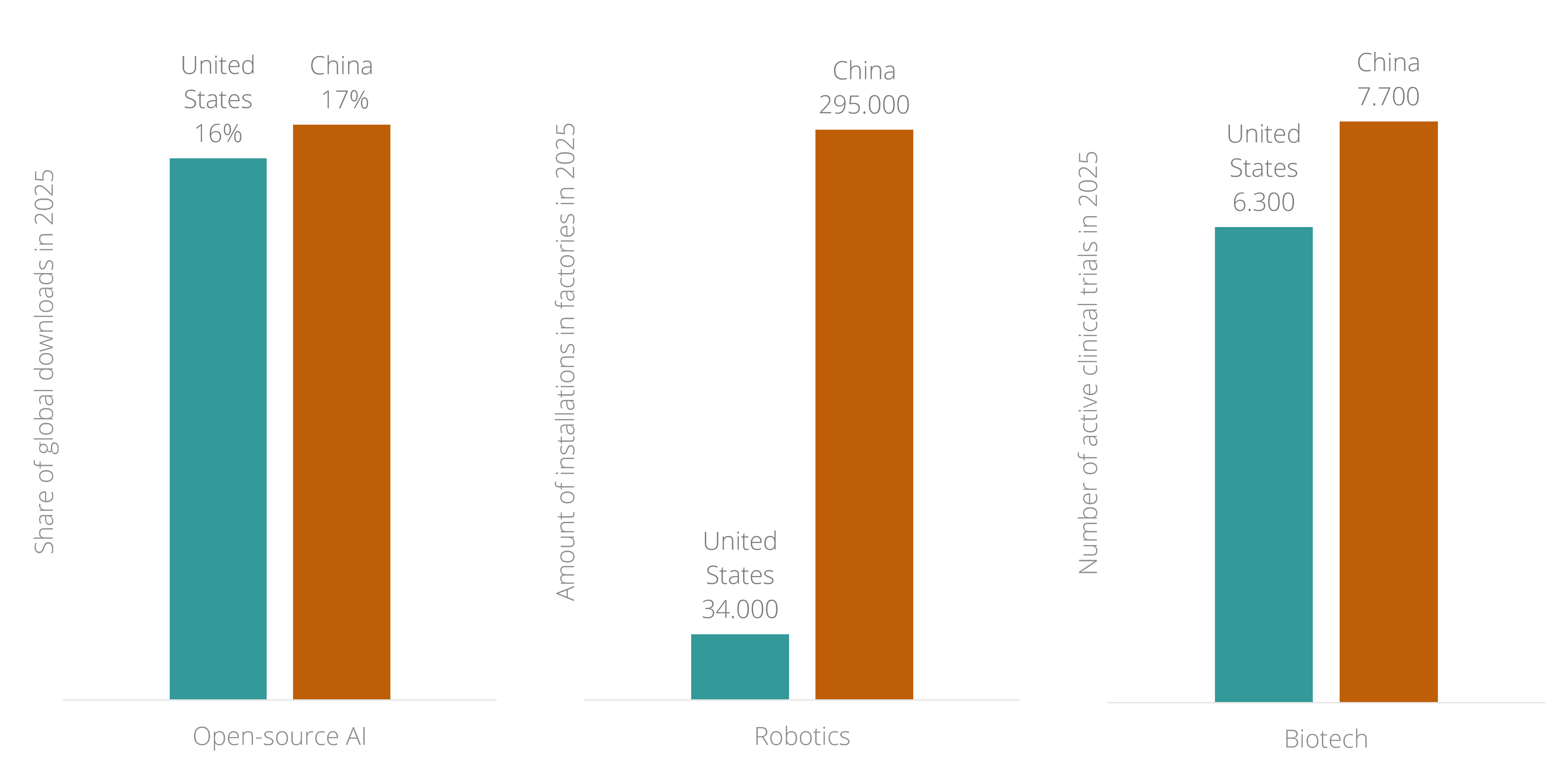

China now leads the US in open-source AI downloads (17% vs 16% globally). It has 8x more industrial robots installed in factories. And it's running more active clinical trials in biotech than the US.

These aren't legacy industries or lab metrics. They're consumer products, factory floors, and drug pipelines.

The question is not whether China is catching up, but whether the West has a good plan for a world where China is leading.